The Future of Finance breakdown 2b: TradFi Hybrid & Shared

Platforms that serve both TradFi and DeFi assets and services are growing in number and maturity

Last week featured a wide range of extreme events in both TradFi and DeFi: massive market turbulence, with the cryptocurrency market cap diving below $1 trillion for the first time since January 2021. Significant action by the Federal Reserve in an attempt to combat inflation. Layoffs across the board with a host of crypto companies including Coinbase, Gemini, Crypto.com and BlockFi. That being said, there is a glimmer of hope as some projects are still hiring, including FTX, Binance and Kraken.

This week we continue building the map of the future of finance across both TradFi and DeFi, with Hybrid & Shared Platforms. This denotes platforms that serve both TradFi and DeFi assets and services, many of which are FinTechs and challenger banking models that have expanded into supporting a broader array of assets.

Remember when The Next Block discussed how there is a hybrid hypothesis for the future, of TradFi and DeFi, suggesting that each are on a path of convergence as they tackle similar challenges to modernize the financial services experience?

As a refresher, we made the following hypotheses::

Hypothesis #1: The future of finance is hybrid & distributed.

Hypothesis #2: The future of DeFi is multi-chain & distributed.

Hypothesis #3: The future of underlying infrastructure is multi-cloud and distributed.

Hypothesis #4: The future of finance governance is hybrid & distributed.

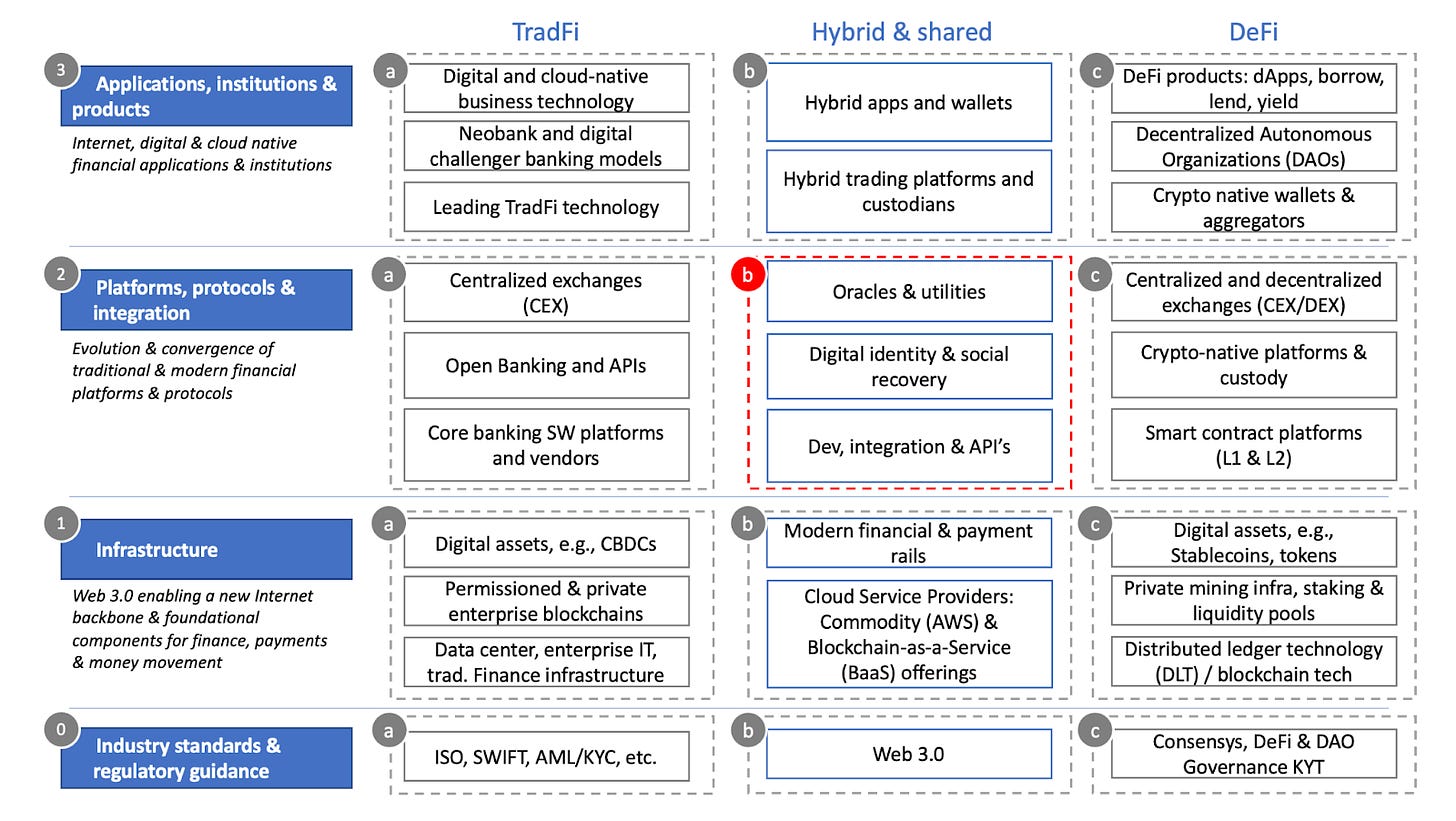

Here’s another refresher on the landscape that we see playing out, keying in on where we will focus in this post:

Figure 1: the future of finance shows a set of hybrid and shared components at the platform layer that serve both TradFi and DeFi across oracles, identity, and development & integration.

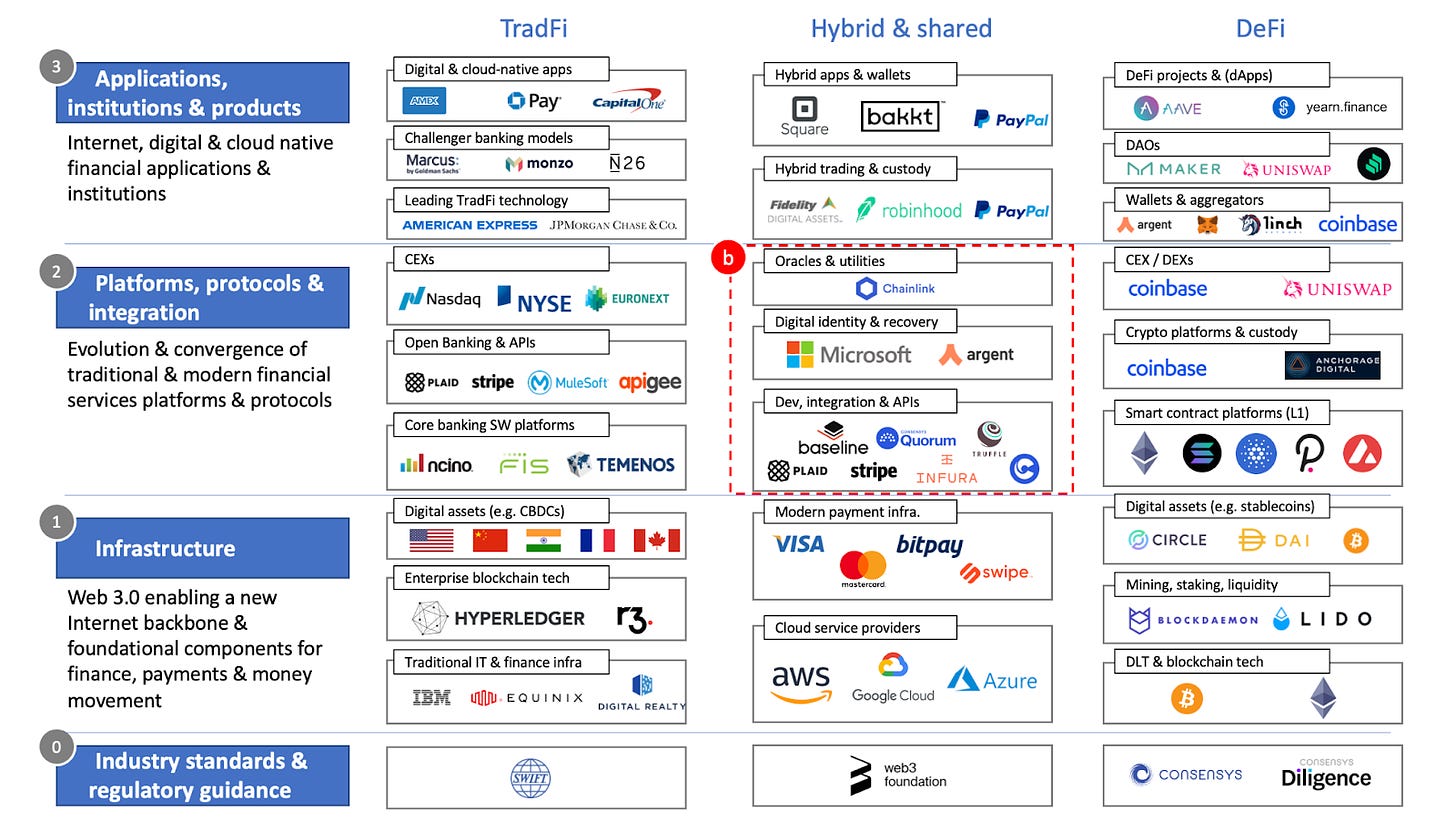

… and the following image shows a view of the respective vendors and projects building out the DeFi Infrastructure of the future:

Figure 2: some of the major players in Hybrid & Shared platforms include Chainlink, Plaid, Stripe, and the Consensys Product Suite.

TradFi Platform component 1: Oracles & utilities.

Given DeFi is decentralized by design, and generally built on blockchain environments that have discrete boundaries of its data and member notes, these environments need a mechanism for connecting with and sharing and consuming data from the outside world.

Oracles are entities that connect blockchains to external systems, thereby allowing smart contracts to execute based on inputs and outputs originating from the blockchain. A decentralized oracle network provides reliable, tamper-proof inputs and outputs for complex smart contracts on any blockchain (e.g. Chainlink). Chainlink is the most widely recognized solution here, and Coinbase has also developed native oracles.

One of the best use cases for oracles are pricing feeds for the market prices of assets, such as cryptocurrencies. Additionally, Chainlink’s ability to securely connect smart contracts with off-chain data and services opens a number of doors for traditional and modern institutions to connect and collaborate.

The leading solution in this space is Chainlink, which is a blockchain-based, decentralized oracle network. It supports most of the major blockchain networks, including Ethereum and Solana.

TradFi Platform component 2: Digital identity & social recovery.

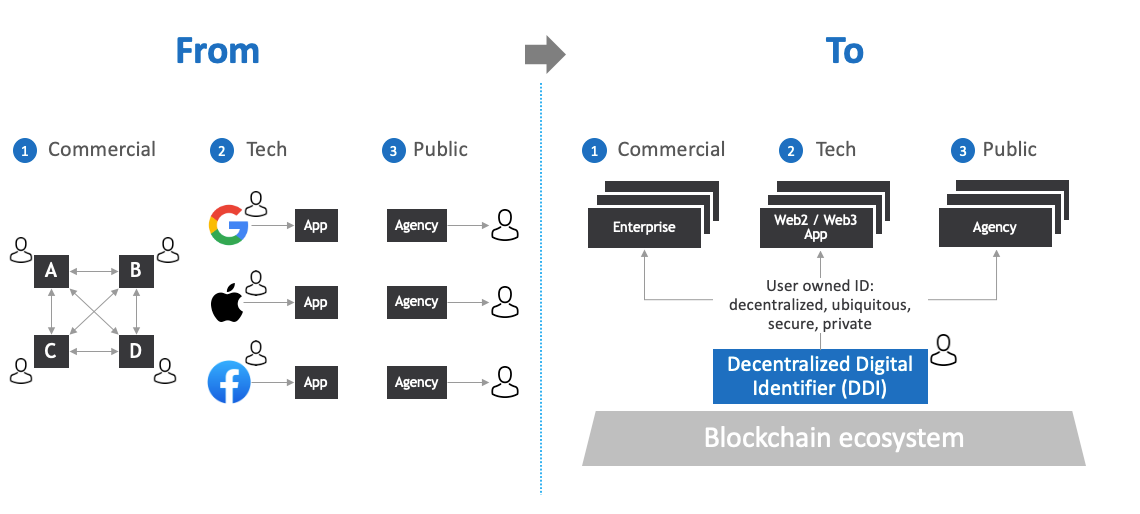

The current model of identity is characterized by an overly complex, highly fragmented ecosystem across organizational entities and individuals. It also provides for identity that is neither ubiquitous and authoritative nor owned by the individual for the identity itself or associated data.

The future model of identity is characterized by: decentralization, privacy by design, user self-control, openness and interoperability, and global scale and accessibility.

We will cover both the current and future model across the three key categories that identity spans:

Commercial sector: to include Fortune 500 companies

Tech: to include Big Tech (Microsoft, Google, Amazon and others) and Web3 & DeFi

Public sector: to include federal and state & local organizations

Figure 3: The state of identity may shift from a fragmented, complex web of commercial, tech and public sector entities independently managing identity, to a decentralized, blockchain based ecosystem that puts the user in control of their privacy, data, and identity.

TradFi Platform component 3: Dev, integration & APIs.

Development. The resources, tools, and general participation in enterprise and consumer grade development of Web3 and DeFi solutions has made great strides in recent years.

Ethereum, which has the most developers of any ecosystem, attracting 20-25% of developers in Web3, has its own native developer tools, runtime environments, programming language and resources for building in its ecosystem to build smart contracts.

The Consensys Product Suite enables developers to build next-generation applications in both a TradFi and DeFi context. The application suite also allows institutions to launch modern financial infrastructure, and empower people worldwide to access the decentralized web. Some examples in the application suite include Codefi for finance and commerce blockchain applications, Infura for developer API access to Web3 resources, Truffle for developer tools and testing, and Quorom (an open source protocol layer developed with JP Morgan) for enterprise TradFi blockchain use cases.

Integration and APIs. Blockchain interoperability is a big new challenge to solve for both blockchain-to-blockchain and blockchain-to-legacy integration and data sharing, as the future will likely remain hybrid and heterogenous, requiring data sharing, integration methods and some form of a “service fabric” for both old and new technologies to coexist.

Enablement of modern banking interoperability both with each other and with more modern tech via Open Banking and APIs is critical – e.g. Stripe, Plaid, Google Open Banking API’s. The Plaid CTO agrees with this and states that data sharing is necessary to both build a full picture, or mosaic, of the financial and customer data landscape, but also sharing and integrating this data in the right way. Recently, a large wave of cryptocurrency-native developments have been made with these digital, yet TradFi-native API players now expanding to become Hybrid & Shared components of the end to end finance stack. For example, Stripe just announced it will enable millions of merchants to convert fiat payments into Bitcoin via OpenNode.

From a pure play crypto perspective, the Baseline Protocol to enable enterprises to build on Ethereum is a great example of protocols that are being developed to hook into the enterprise community.

Enterprise customers wanting to build blockchains solutions want enterprise grade methods of building blockchain environments and enabling interoperability with other conventional systems of record and database technologies. Solutions like the Hyperledger fabric, Consensys Quorom and others are available to build in a modern way that can also nest within an existing, heterogeneous technology ecosystem. Read more here on TechCrunch.

Read more here on The Great Protocol Sink from Bankless to understand how protocols will establish the integration between traditional financial institutions and DeFi for a more integrated future.

Read more here from Andreesen Horowitz on how the fiat and crypto worlds are converging.

Chart of the Week:

Once over $100 billion, the Total Value Locked (TVL) in DeFi has sunk to just under $40 billion in the wake of recent market and cryptocurrency turbulence.

Catch up on our most recent publications from The Next Block.

TradFi and DeFi: a hybrid hypothesis

Future of Finance - TradFi and DeFi Reference Architecture and Component Deep Dive

TradFi & DeFi deep dive 1(a): TradFi Infrastructure

TradFi & DeFi deep dive 1(b): Hybrid & Shared Infrastructure

TradFi & DeFi deep dive 1(c): DeFi Infrastructure

TradFi & DeFi deep dive 2(a): TradFi Platforms

Decentralized Identity and the Reclamation of Your PrivacyThe Next Block’s 2021 Year in Review

The Ultimate Resource for Becoming a TradFi and DeFi Expert

The Next Block's 2022 TradFi and DeFi Predictions

Must reads & weekly rollup.

Group 1: Traditional Finance (TradFi)

Federal Reserve raised interest rates by 75 bps, taking aggressive action in a high inflationary market (New York Times, Federal Reserve)

Citi partners with Metaco to develop institutional digital asset custody capabilities (FinTech News)

Goldman Sachs is raising $2 billion from investors to buy distressed assets from troubled crypto lender Celsius (Fortune)

JP Morgan is using payments data to woo merchants from FinTechs, sourced from its massive consumer card-spending database and card-processing operations. (American Banker)

JP Morgan wants to bring trillions of dollars of tokenized assets to DeFi for institutional grade financial instruments, which could include US Treasurys or money market fund shares (CoinDesk)

Citigroup plans to hire 4,000 technology staff to tap Into “digital explosion”, and seeks to put more institutional client services online (Bloomberg)

Citi says crypto market volatility has affected user adoption, and concerns about stablecoins following UST’s collapse have exacerbated declines in digital asset prices, the bank said (CoinDesk)

American Express is making it faster and simpler for fintechs to bring their payment innovations to market on its global payments network. Amex took another step with Abra’s announcement to launch the first cryptocurrency rewards credit card on the American Express network (American Express)

CNBC reports that investors worry another possible crypto collapse will bring down other key players (CNBC)

Goldman Sachs conducted a Bitcoin survey that showed insurers are beginning to warm up to crypto investing, indicating 6% were invested in crypto or considering doing so (Forbes)

UBS CEO says digital euro not risky if done properly, and a digital euro would carry benefits in terms of "fast and cheaper" execution as well as trustworthiness (Reuters)

BNY Mellon, Barclays, and 12 banks trial Finteum blockchain intraday FX swaps, repo (Ledger Insights)

Deloitte announced a strategic alliance designed to help companies of all sizes implement digital asset capabilities in their businesses (PRN)

Group 2: Decentralized Finance (DeFi)

Celsius defies fear of implosion as token soars 218% (The Defiant); Celsius also hires more advisors ahead of possible bankruptcy (The Block)

Circle, the issuer of US Dollar Coin (USDC), to introduce a euro-backed stablecoin; the Euro Coin will be backed by euro-denominated reserves held by U.S.-regulated financial institutions (CoinDesk)

Circle announces support for Polygon USDC on Circle’s platform. Businesses can now deposit and withdraw Polygon USDC using the Circle Account and Circle APIs, no manual bridging required. (Circle)

BlockFi is in the process of raising a down round, in which funds will be raised at a lower valuation compared to previous raises, at a $1 billion valuation (The Block)

Ethereum touches ~$1,069 (ETH), its lowest price since 2020, ahead of The Merge, one of the highest anticipated events in crypto history (The Next Bock)

Coffeezilla has made a name for himself on YouTube exposing crypto scams and other con artists (The New Yorker)

Coinbase, BlockFi, Crypto.com, Robinhood and Gemini are all announcing large scale layoffs in the wake of market turbulence (Coinbase: Bloomberg; BlockFi and Crypto.com: The Verge, Blockworks; Robinhood: TechCrunch; Gemini: CoinDesk)

Binance meanwhile is doubling down and continues to hire and build for the future, with 2,000 positions they intend to recruit for (Reuters)

BlockFi received a $250 million revolving credit facility from FTX. The proceeds will be used to fulfill client balances across all accounts (CoinDesk)

Solana is making a crypto phone with help from former Essential engineers (The Verge)

Coinbase adds support for on-chain Polygon and Solana transactions, adding its first major integrations with Layer 2 technology (CoinDesk)

Group 3: Blockchain and Cryptocurrency (Web3, Metaverse, Digital Assets, Big Tech, FinTech, Government)

Biden takes big step toward government-backed digital currency, throwing its support behind further study and development of what would be known as a U.S. CDBC (NBC)

MicroStrategy holds the largest Bitcoin position of any corporate entity in its treasury, but faces pressure as the price of Bitcoin drops to ~$21k, suggesting a potential margin call. MicroStrategy currently holds 129,218 BTC at an average price of $30,700 (CNBC)

Intelligencer reports on the rise and fall of Cathie Wood, the most famous high tech and innovation money manager for ARK Invest who has predicted Bitcoin would hit $1 million (Intelligencer)

DARPA released a report that finds vulnerabilities in blockchain technology, challenging the security of the ledger technology that blockchain software runs on (Defense Systems)

Apple sidelines Goldman Sachs and goes in-house for lending service (Financial Times)

Gucci buys into the SuperRare DAO, eyeing the new virtual art space (The Block)

Cristiano Ronaldo signs NFT deal with crypto exchange Binance (Financial Times)