The Future of Finance breakdown 2a: TradFi Platforms

The cornerstone of most TradFi's are shifting towards a digital-native, cloud-native, and even DeFi friendly future!

Last week was filled with developments all across TradFi, DeFi and Big Tech, including some very bearish events such as cutbacks and layoffs across leading US crypto exchanges like Coinbase and Gemini, a new outage on the Solana blockchain, and a highly turbulent crypto market.

This week we continue building the map of the future of finance across both TradFi (Traditional Finance) and DeFi (Decentralized Finance), with TradFi Platforms.

Remember when The Next Block discussed how there is a hybrid hypothesis for the future, of TradFi and DeFi, suggesting that each are on a path of convergence as they tackle similar challenges to modernize the financial services experience?

As a refresher, we made the following hypotheses::

Hypothesis #1: The future of finance is hybrid & distributed.

Hypothesis #2: The future of DeFi is multi-chain & distributed.

Hypothesis #3: The future of underlying infrastructure is multi-cloud and distributed.

Hypothesis #4: The future of finance governance is hybrid & distributed.

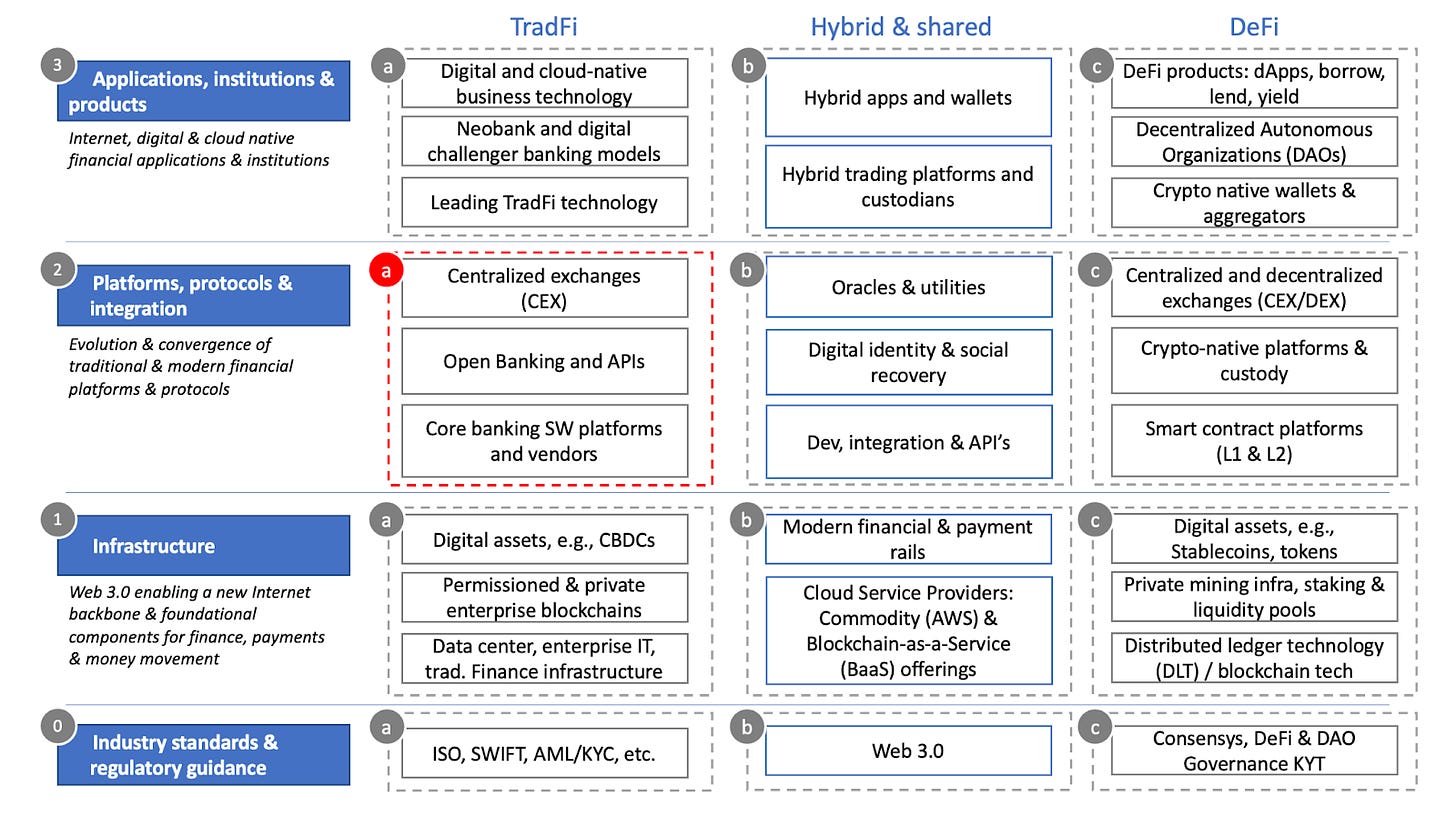

Here’s another refresher on the landscape that we see playing out, keying in on where we will focus in this post:

Figure 1: the future of finance shows TradFi platforms as a key building block for today’s incumbents that are shifting to digital, cloud-native, and even DeFi in some cases

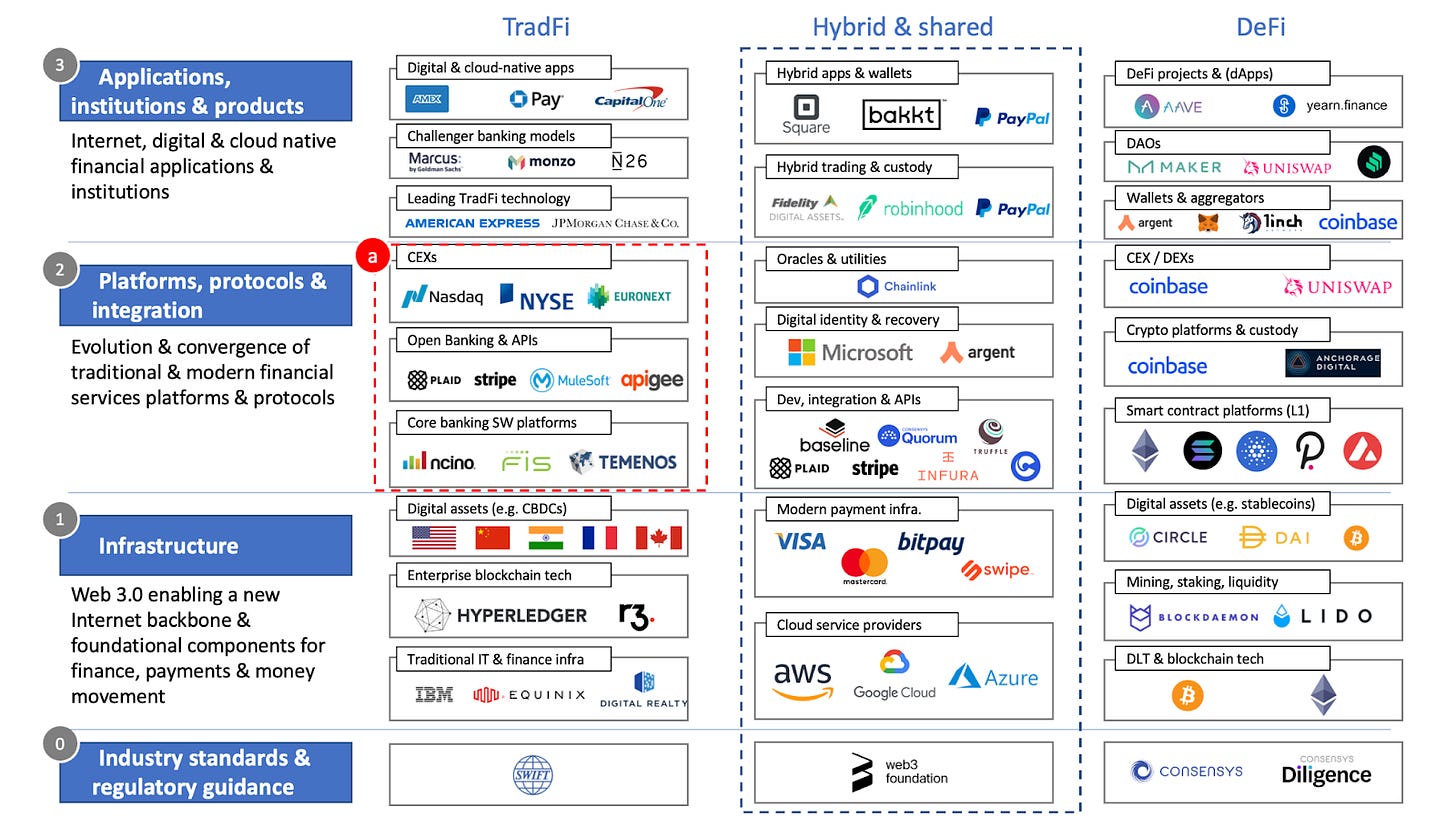

… and the following image shows a view of the respective vendors and projects building out the DeFi Infrastructure of the future:

Figure 2: TradFi platform components include Centralized Exchanges (CEX), Open Banking and API’s, and Core banking software platforms

TradFi Platform component 1: Centralized Exchanges (CEX)

This bucket represents the Centralized Exchanges (CEX) that most TradFi’s like capital markets institutions interact with, such as the New York Stock Exchange (NYSE), the NASDAQ, Shanghai Stock Exchange, and Euronext.

Key to note that there is movement in this space where TradFi exchanges are starting to shift towards the “Hybrid and Shared” column of our future of finance landscape. A great example is exhibited by NASDAQ Marketplace Services Platform and Cryptocurrency Exchange Software to support crypto exchanges.

TradFi Platform component 2: Open Banking and API’s

Prior to Open Banking and API’s, most TradFi’s used a complex, fragmented web of bespoke services and point to point integrations for internal and cross-TradFi communications. Open banking has since allowed TradFi’s and FinTechs to much more easily communicated to share financial data with various third party software for payments, account aggregation, and other digital-native capabilities that conduct financial services.

The FinTech natives that initially disrupted this space include Plaid, which allows for instant TradFi account authentication, connections to any US bank, and frictionless payments.

Also, Stripe, which primarily provides payments services infrastructure for internet based companies, ecommerce and mobile applications, as well as other financial services and business operations. Stripe provides APIs that developers and engineers can leverage to integrate payment processing services from TradFi’s into web and mobile apps. Recently, Stripe also announced it will enable millions of merchants to convert payments into Bitcoin via OpenNode, showing that it is expanding its payments infrastructure to include digital assets and cryptocurrencies.

Additionally, the Cloud Service Providers (CSPs) are entering this space as the rise of the “industry cloud” is taking hold for all industry verticals in public cloud. Notably, Google Cloud’s open banking and embedded finance offering, on the back of its Apigee offering, is a means for TradFi to enable open banking in a cloud-native way.

TradFi Platform component 3: Core banking software platforms

Core banking software platforms, and other core financial services, for those TradFi’s that wish to “buy” versus “build” custom and leverag Commercial-off-the-Shelf (COTS) platforms to suit their needs. While some players of significant scale, technology budgets, and in-house talent can develop custom solutions, a majority of banks use vendor solutions that are configured and customized to their needs. FIS, nCino, Thought Machine and Temenos are great examples.

Many of these platforms have started to shift to (1) both digital and cloud-native offerings, and (2) also starting to trend towards the “Hybrid and Shared” column of our future of finance landscape by starting to offer services in the digital assets and crypto space. For instance, FIS serves a number of TradFi customers as well as DeFi-natives to provide blockchain services such as its Card-to-Crypto offering.

… if you want to read more, check out the full post here to better understand the trends, vendors and projects for DeFi Infrastructure that is forming the future of finance for TradFi and DeFi.

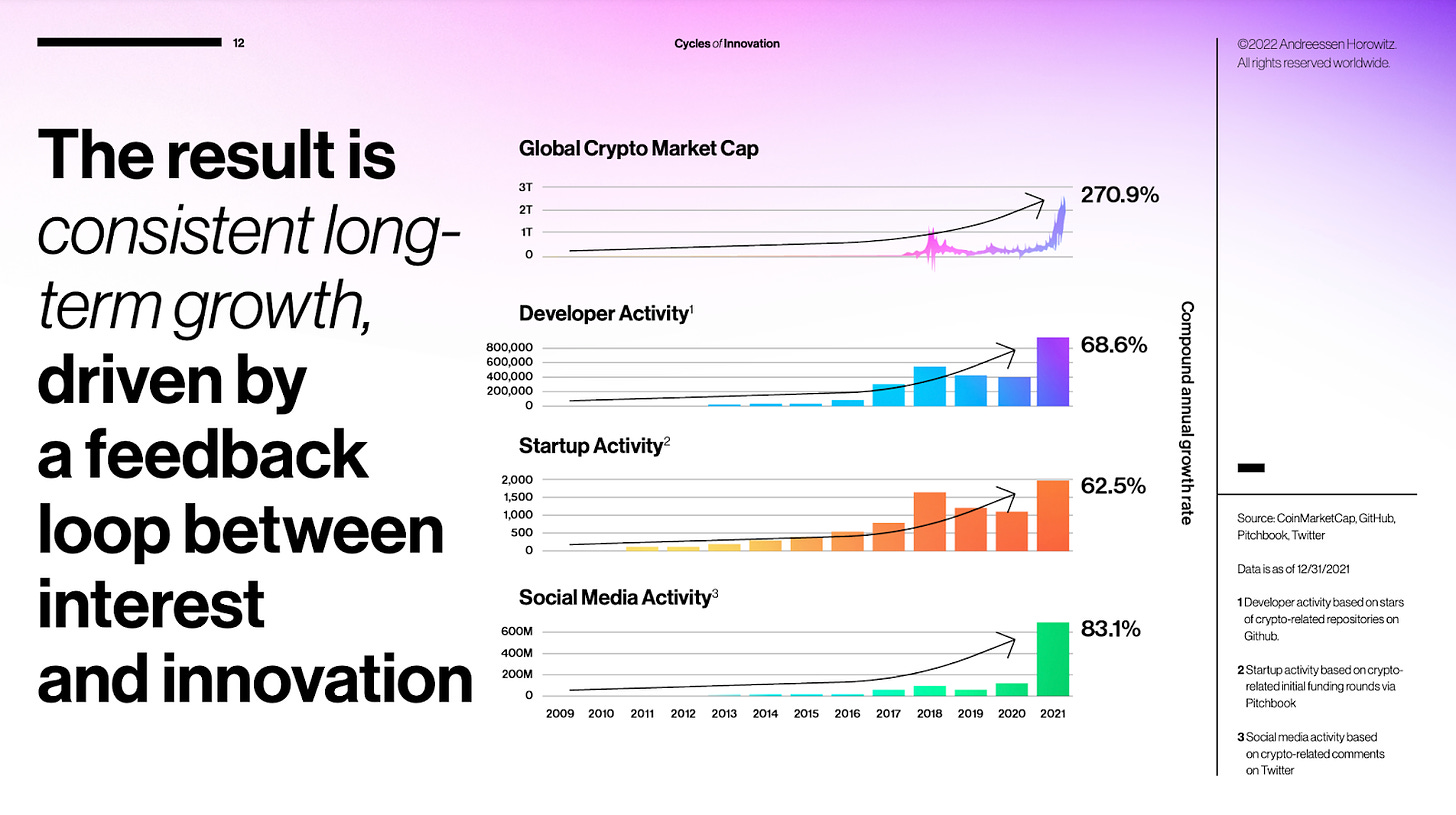

Chart of the Week:

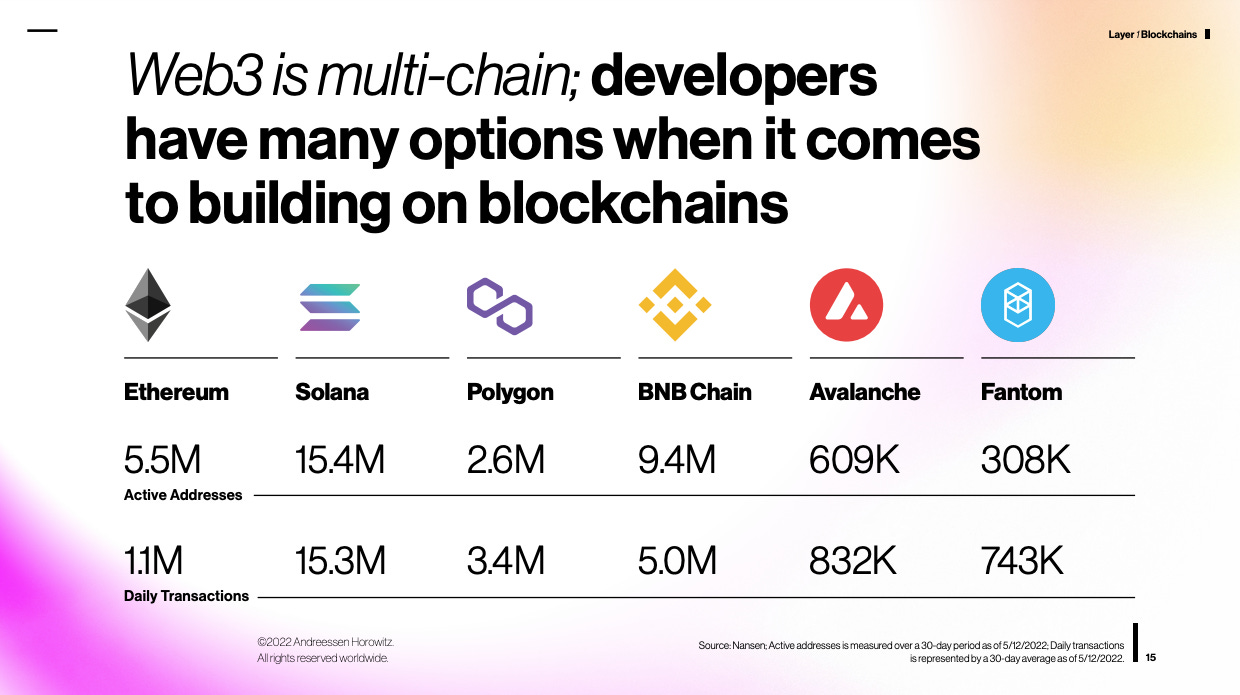

Some key highlights from the recent a16z 2022 State of Crypto Report as it relates to Ethereum and DeFi:

… while the market has appeared turbulent and with major drawbacks in the overall market cap as well as individual projects (e.g. Terra), the long term horizon shows a large increase in overall market cap, developer, startup, and social media activity.

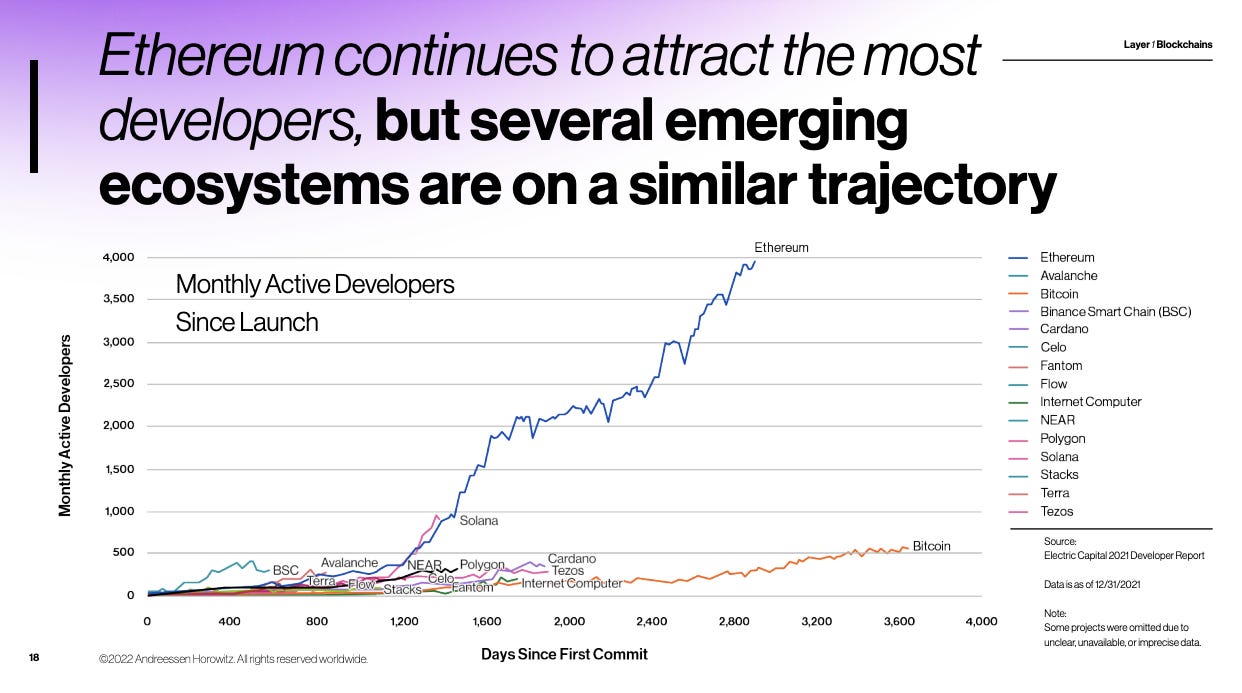

… within that market growth has featured a number of L1 smart contracts platform competitors to Ethereum, including Solana and Avalanche.

… however, Ethereum continues to attract the most developers, while concurrently there have been notable outages and issues with competitors such as the Solana outage and the Terra ecosystem collapse and stablecoin depeg.

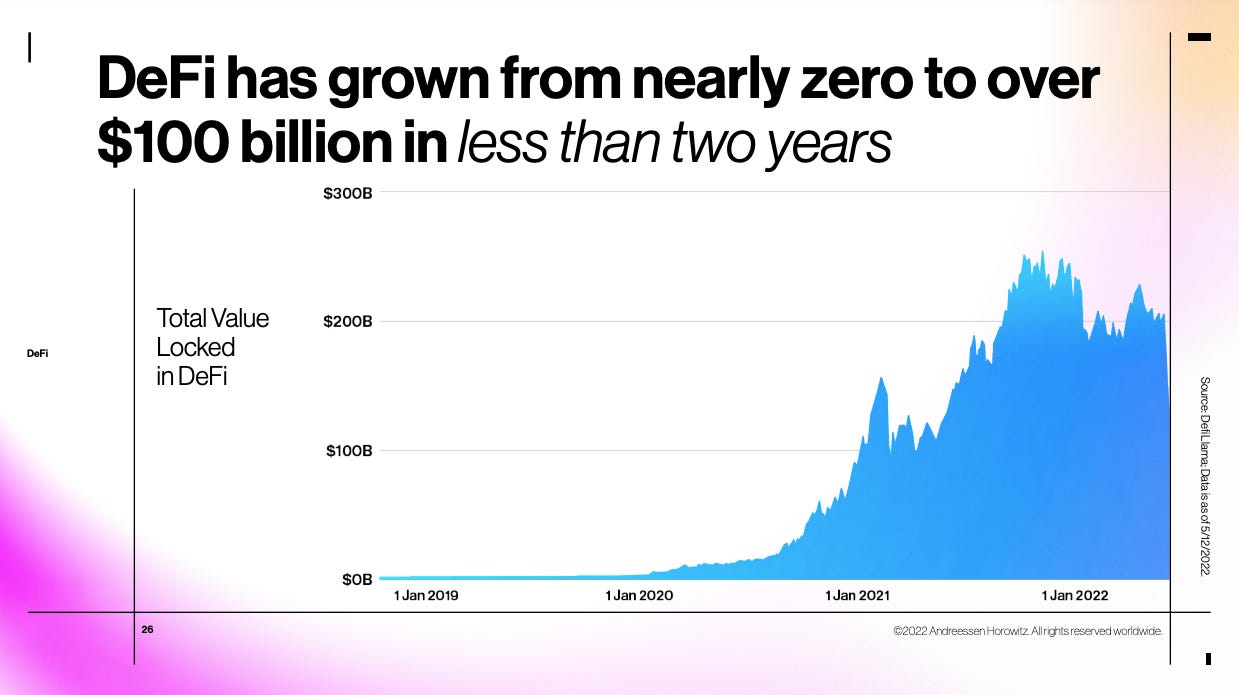

… and DeFi, largely built upon Ethereum, has exponentially grown to over $100 billion in less than two years, clearing $200 billion in Total Value Locked (TVL) in 2021.

Catch up on our most recent publications from The Next Block.

TradFi and DeFi: a hybrid hypothesis

Future of Finance - TradFi and DeFi Reference Architecture and Component Deep Dive

TradFi & DeFi deep dive 1(a): TradFi Infrastructure

TradFi & DeFi deep dive 1(b): Hybrid & Shared Infrastructure

TradFi & DeFi deep dive 1(c): DeFi Infrastructure

Decentralized Identity and the Reclamation of Your PrivacyThe Next Block’s 2021 Year in Review

The Ultimate Resource for Becoming a TradFi and DeFi Expert

The Next Block's 2022 TradFi and DeFi Predictions

Must reads & weekly rollup.

Group 1: Traditional Finance (TradFi)

Andreesen Horowitz just published its 2022 State of Crypto Report (a16z)

Fidelity plans a crypto hiring spree of tech talent as well as ambitions to expand to digital assets broader than its recent Bitcoin for 401k announcement (Wall Street Journal)

JP Morgan is considering using blockchain technology to tokenize equities and other traditional securities using blockchain technology (The Daily Hodl, Ledger Insights)

Thought Machine, a cloud based core banking platform, executes a $160 million round led by Temasek to continue to help TradFi’s transition away from legacy IT systems (Tech EU)

Barclays and Goldman Sachs engage in a $70 million investment in Elwood Technologies, a crypto focused platform (TechCrunch)

Nomura plans to launch an institutional digital asset company, and will operate as a wholly segregated entity with its own capital and resources to enhance time-to-market and innovation (The Trade)

The Federal Reserve in a survey finds divergent uses of crypto based on income, those who use it as an investment and those who rely on it for transactions (American Banker)

American Banker suggests that TradFi incumbents could bring stability to the stablecoin market (American Banker)

Andreesen Horowitz establishes yet another crypto fund, its fourth, at $4.5 billion, doubling down on this space despite the recent market downturn (CoinDesk)

Group 2: Decentralized Finance (DeFi)

Coinbase details out cost-cutting measures and employee grants amid weak results and rout in the crypto markets (CoinDesk)

Coinbase is also listed as the first crypto company ever to make the Fortune 500 (CoinDesk)

Gemini cuts 10% of staff in the midst of a turbulent cryptocurrency market along with macroeconomic market conditions (CoinDesk)

FTX, a leading crypto exchange, has held acquisition talks with Webull, Apex, and Public.com, suggesting it might break into stock trading (Decrypt)

Brave browser now integrates with the Solana blockchain, expanding access to Web3 for the entire Brave ecosystem (Brave)

Ripple collaborated with TradFi consultancy Oliver Wyman to discuss how financial intermediaries can integrate crypto assets (Ripple)

Binance Labs closes a $500 million fund to focus on web3 and blockchain adoption (TechCrunch)

FTX surpassed Coinbase in Bitcoin volume for the first time ever (Decrypt)

Group 3: Blockchain and Cryptocurrency (Web3, Metaverse, Digital Assets, Big Tech, FinTech)

Amazon Web Services provides a Forrester report on how open finance will reshape financial services over the coming decade (AWS Marketplace)

GameStop launches a beta version of its non-custodial, Ethereum browser wallet which will support Layer 2 transactions on the Loopring network (DeFiant)