The Ethereum Merge Will Change The Course Of Crypto

The first major blockchain switching its consensus mechanism and largest crypto enhancement in history.

Last week featured a TradFi & DeFi deep dive on section 2(c) of the hybrid reference architecture regarding DeFi Platforms. Before continuing on to addressing the Applications layer, this week we will focus on one of the biggest events in Web3 history, and the first major blockchain switching its consensus mechanism.

We are only days away from the Ethereum Merge, a transition from the energy intensive Proof of Work (PoW) to the Proof of Stake (PoS) consensus mechanism, which consequently will decrease its energy usage by 99.5%. In fact, the Ethereum merge date was just announced for September 15-16 (see the latest countdown here)!

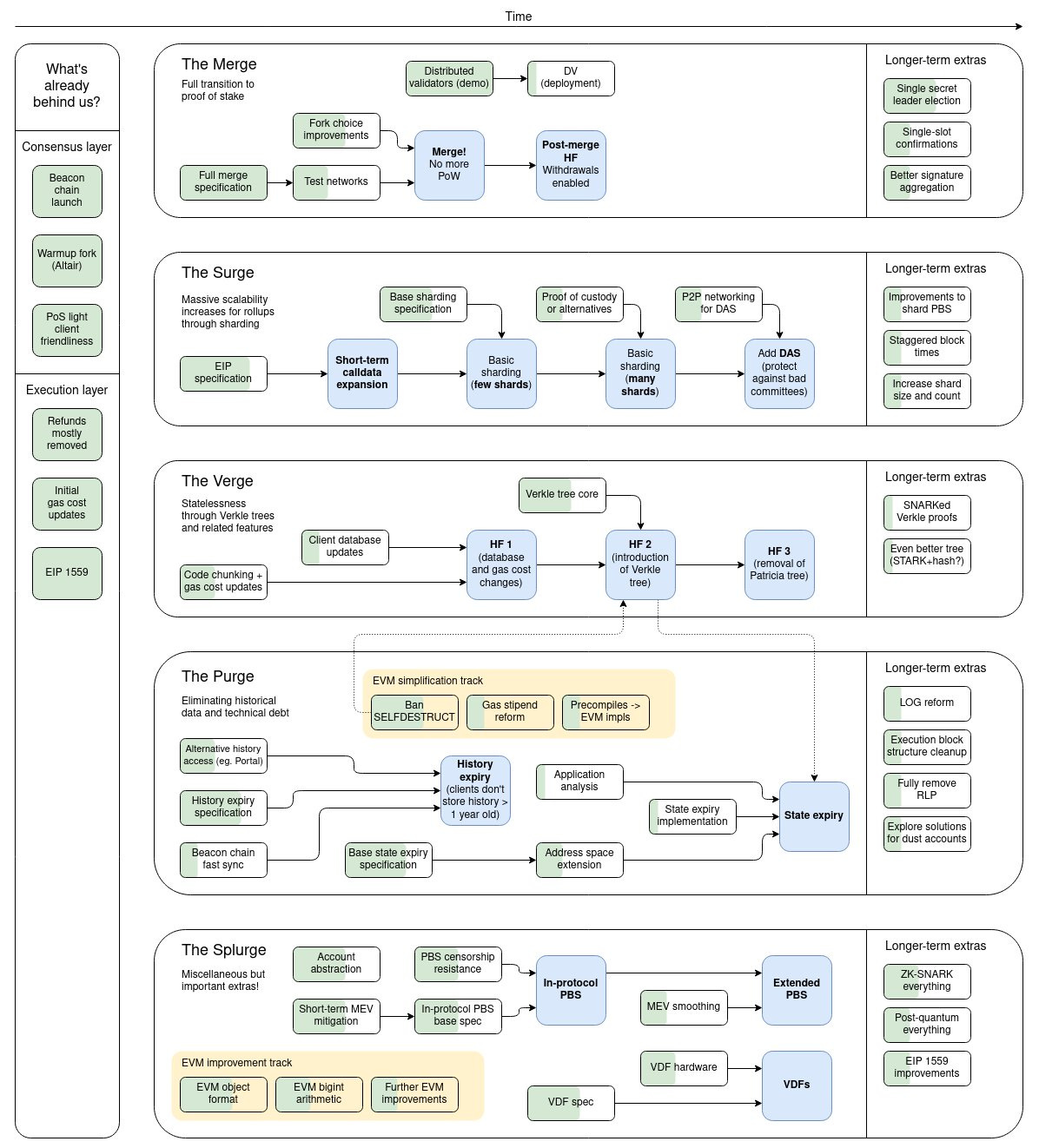

Vitalik Buterin delivered a presentation recently reviewing the broader Ethereum roadmap: The Merge, The Surge, The Verge, The Purge, and The Splurge.

Let’s examine each set of activities in more detail.

The Merge.

Full transition to Proof of Stake (PoS).

The transition to PoS promises to improve the network’s sustainability, security and economic durability, and is the most significant update to Ethereum since its launch in 2015 (Consensys).

The changes are predicted to have the following effects:

Ethereum is going green as it will use 99.95% less energy in a PoS consensus model

There will be a 90% reduction in ETH issuance and will potentially become a deflationary asset

Staking rewards will be boosted

No new ETH will enter circulation for 6 months

Sets the stage for future scalability updates like sharding

(Source: Argent)

Check out these great resources for all things related to The Merge:

Coinbase: The Ethereum Merge is Coming: Here’s what you need to know

Chainalysis: How The Ethereum Merge May Impact the Crypto Ecosystem: On-chain Indicators to Watch

Argent: The Merge is coming. Here’s what you need to know

Finematics (Youtubue video): Ethereum Merge - the most anticipated event in crypto explained

The Surge.

Massive scalability increases for rollups through sharding. Sharding is a broader technology and data concept where rather than having a centralized data store, or in blockchain’s case, a decentralized model where you can split a network into logical partitions that have the appropriate mechanisms to comprise a total authoritative data set in aggregate. This requires logic like balance and control across each “shard” to ensure there are no duplicative, erroneous, or fraudulent transactions to compromise any individual shard or the entire blockchain

Sharding would work in tandem with Layer 2 rollup technologies in order to scale to what is estimated as an eventual 100k+ transactions per second. In the case of Ethereum, these shards will give Ethereum more capacity to store and access data, but they won’t be used for executing code.

Read more here on Ethereum about sharding and how it will be one of the upgrade stages that follows The Merge. Also, check out Vitalik Buterin’s post on sharding.

The Verge.

The Verge aims to achieve statelessness through Verkle trees and related features. Verkle trees are shaping up to be an important part of Ethereum's upcoming scaling upgrades. They serve the same function as Merkle trees: you can put a large amount of data into a Verkle tree, and make a short proof ("witness") of any single piece, or set of pieces, of that data that can be verified by someone who only has the root of the tree.

Simply put, Verkle tress are a powerful upgrade to Merkle proofs that will significantly reduce and optimize Ethereum’s storage requirements as well as Ethereum node size. Read more here from Vitalik Buterin.

The Purge.

The Purge aims to eliminate historical data and technical debt from Ethereum validator nodes. This will significantly reduce infrastructure requirements and offload historical data greater than one year old to other resources, relieving retention and archival requirements as far as nodes are concerned.

The Splurge.

The Splurge contains miscellaneous but important extras! This includes a number of catch all items for optimization of the Ethereum blockchain such as account abstraction.

(Source: Miles Deutscher | Twitter)

Catch up on our most recent publications from The Next Block.

TradFi and DeFi: a hybrid hypothesis

Future of Finance - TradFi and DeFi Reference Architecture and Component Deep Dive

TradFi & DeFi deep dive 1(a): TradFi Infrastructure

TradFi & DeFi deep dive 1(b): Hybrid & Shared Infrastructure

TradFi & DeFi deep dive 1(c): DeFi Infrastructure

TradFi & DeFi deep dive 2(a): TradFi Platforms

TradFi & DeFi deep dive 2(b): Hybrid & Shared Platforms

TradFi & DeFi deep dive 2(c): DeFi Platforms

Decentralized Identity and the Reclamation of Your Privacy

The Next Block’s 2021 Year in Review

The Ultimate Resource for Becoming a TradFi and DeFi Expert

The Next Block's 2022 TradFi and DeFi Predictions

Must reads & weekly rollup.

Group 1: Traditional Finance (TradFi)

JPMorgan hires former Microsoft executive to its Digital Assets-related payments group. Microsoft’s former corporate treasurer and chief investment officer Tahreem Kampton joined JPMorgan Payments, which focuses on digital payments and blockchain technology. (CoinDesk)

Bank of America believes the Ethereum Merge will lead to Greater Institutional Adoption of Ether. Investors who are barred from buying tokens that run on proof-of-work systems may be able to buy ether after the blockchain switches to proof-of-stake, the bank said (CoinDesk)

KKR dives into the Avalanche blockchain to tokenize and democratize financial services, a step that may provide institutional private market strategies to more individual investors (TechCrunch)

BNP Paribas Securities selects Fireblocks, METACO for digital asset custody (Ledger Insights)

BNY Mellon and Goldman Sachs execute its first security lending deal on the HQLA(x), a distributed ledger-based tokenization platform; the 35-day term transaction was for hundreds of millions of dollars (Ledger Insights)

JP Morgan is developing an “internet of money” through Onyx, its blockchain and digital assets team of 200 developers and other business leaders (American Banker)

Barclays will be among the investors in cryptocurrency custody firm Copper's funding round (CoinDesk)

Moelis, an elite boutique investment bank, is ramping up a group focused on global blockchain transactions (Bloomberg)

BlackRock has selected Coinbase to provide Aladdin clients (its investment platform) with new access points for institutional crypto adoption by connecting to Coinbase Prime. (Coinbase)

The European Central Bank (ECB) published a paper that explores blockchain solutions to cross border payment challenges (Ledger Insights)

Morgan Stanley’s Wealth Management division made a job job posting that points to its wide-ranging crypto plans (The Block)

BlackRock, fresh off its Coinbase partnership and integration, offers direct #Bitcoin exposure. The institutional-investor-focused spot bitcoin private trust will track the price of the cryptocurrency (CoinDesk)

Group 2: Decentralized Finance (DeFi)

Vitalik Buterin gave significantly more transparency into the Ethereum Merge, and the subsequent phases of development for Ethereum (YouTube, Twitter)

Coinbase jumps 14% after saying it has no exposure to bankrupt crypto firms (CNBC)

Voyager Digital, a crypto brokerage firm, files for Chapter 11 bankruptcy protection after suffering huge losses from its exposure to Three Arrows Capital (CNBC)

Three Arrows Capital, a crypto hedge fund, ordered by a court in the British Virgin Islands to liquidate following creditor lawsuits over the crypto hedge fund’s failure to repay loans (WSJ)

Three Arrows also in a separate announcement filed for Chapter 15 bankruptcy (CNBC)

dYdX, a popular crypto native derivatives exchange, plans to expand to its own blockchain in the Cosmos ecosystem, marking an expansion beyond the Ethereum ecosystem (The Block)

Coinbase Prime has added Ethereum staking for US Institutional clients (CoinDesk)

Group 3: Blockchain and Cryptocurrency (Web3, Metaverse, Digital Assets, Big Tech, FinTech, Government)

MicroStrategy files to sell up to $500M of stock to fund Bitcoin purchases. The deal is a sign Executive Chairman @saylor isn't backing off his audacious plan to turn his software developer into a bitcoin proxy. (CoinDesk)

The US Securities and Exchange Commission (SEC) is working to get some crypto lending companies properly registered if they operate more as investment firms (Reuters)

The SEC is also investigating Coinbase over whether or not it has listed securities on its exchange; Coinbase responds with its position (The Verge; Coinbase)

US Senators push forward a bill proposing that small cryptocurrency transactions have tax free treatment (CoinDesk)

US House also delays consideration of a stablecoin bill (Reuters)

Tesla sold 75% of its Bitcoin in Q2 2022 according to its full financial report, with Elon Musk citing liquidity concerns from COVID shutdowns in China as the primary driver (The Verge)

FinTech valuations plummet, shedding almost half a trillion dollars this year compared to their peak valuation (Peer2Peer Finance News)

MicroStrategy CEO @saylor will step down and become Executive Chairman. Phong Le, who had previously served as the company's president, CFO and COO, will become the new CEO (CoinDesk)

Meta confirms NFT rollout across 100 countries, following a series of testing phases and amid Coinbase integration (CoinDesk)

Robinhood is cutting about 23% of jobs, releases second-quarter earnings (CNBC)

US Treasury black listed Tornado Cash, a crypto mixing service, for alleged use in money laundering; some suggest this also puts honest crypto investors at risk of criminal exposure. (CNBC)

U.S. Lawmakers Look to Digital Dollar to Compete With China; the Federal Reserve is considering the idea, but in no rush to join a digital-assets space race (WSJ)

Starbucks to Offer NFT-Based Loyalty Program Using Polygon's Blockchain Technology; Starbucks Odyssey will allow customers to purchase digital collectible stamps in NFT form that offer benefits and immersive experiences (CoinDesk)