Software Is Eating The World. Next It Will Be Tokenized.

Unlocking Digital Asset Potential with Web3 and the Power of Tokenization

In 2011, Andreesen Horowitz famously stated that Software Is Eating The World, which turned out to be true for the decade of the 2010s. For the next decade, I believe that tokenization has the potential to eat the world and all of its assets, both digital-native and real world.

In Web3, digital assets are becoming more and more ubiquitous to DeFi and other industry projects. It is also starting to pick up steam in TradFi. While traditional banks and capital markets players have largely avoided DeFi, these institutions clearly want to embrace Web3 technology to apply it to its own financial instruments, assets and operational processes. Even in the midst of a highly erratic 2022 for DeFi, with the market going into crypto winter, and a number of high profile CeFi exchanges and projects collapsing, they commitment to developing this technology remains. This has brought significant questions about the future of certain cryptocurrencies, and DeFi as a whole, if TradFi will leverage Web3 and blockchain technologies for its own native solutions and financial ecosystem.

Regardless of these market dynamics, TradFi seems to be unfazed in its faith in the underlying technologies that Web3 has brought to bear, and is actively investing in those tech capabilities to its own advantage.

In order to fully leverage the potential that Web3 tech has to offer, organizations must identify the use cases best suited to adopt web3 technology and tokenization strategies. This can happen through new product development, or legacy modernization of existing products, platforms and infrastructure where Web3 tech may present a better way of doing things. There are a host of use cases in TradFi, including securitization, loan syndication, capital raising, and others where institutions are considering if blockchain, tokenization and smart contracts will greatly enhance these financial instruments and their underlying systems and operational processes.

For legacy modernization, this is no easy feat given the complexity of transitioning from traditional systems and processes to newer models employing emerging technology, and most TradFi’s are evaluating the business case for change, and if DeFi will truly be disruptive enough to warrant overhauling their own estates as well.

In this post we explore the benefits and drawbacks associated with pursuing a tokenized asset strategy powered by blockchain based platforms. We’ll also explore specific tips on how business and technology leaders can embrace new technologies such as DeFi protocols while still protecting their bottom lines. Together let's unlock the power of digital assets with web3 tech and 3the power of tokenization – it could be a game changer for your business!

Introduction: An overview of tokenization and its benefits

Generally speaking, tokenization itself is not novel to Web3, and is manifest in many of the Internet-enabled resources you use today. Tokenization is a process used to secure sensitive data by replacing it with an alphanumeric sequence of characters. Tokenization is used in payment processing and other data-sensitive industries to protect the original data, such as credit card numbers, bank account details, social security numbers, and passwords. It works by first collecting the sensitive information, then masking it with an algorithmically generated token. This token uniquely identifies the original data but does not reveal any of its contents. The token can then be used instead of the original data for transactions or other activities that would require access to confidential information.

Because tokenization greatly reduces the risk of fraud and data theft, it has become hugely popular among businesses who rely on online payments and digital records for their operations. By replacing customer’s personal information with a secure token, companies can prevent identity theft and unauthorized access to private information. Furthermore, since tokens are much smaller than their corresponding original values (usually about 16 characters compared to a credit card number's 16 digits), they can decrease processing time significantly because less data needs to be exchanged between parties during transactions.

Tokenization also benefits customers by providing an additional layer of security when they make purchases or exchange confidential information online. Since tokens keep all sensitive information out of reach from criminals, it is much harder for hackers to obtain access and exploit the user's identity or financial details. Additionally, if a breach were to occur, tokenized credentials would be extremely difficult for attackers to decode since only authorized personnel have access to the encryption key needed for decoding them back into their original form.

All in all, tokenization offers many advantages over traditional methods of data storage and transmission — from improved security measures and shorter transaction times to decreased costs related to fraud prevention and compliance efforts. As this technology continues to evolve in sophistication, businesses will continue to reap the rewards associated with using a secure technique like tokenization that safeguards their customer’s confidential information while allowing them to conduct business without worrying about potential breaches or identity theft issues.

Practical Examples of Tokenization

The traditional approach to tokenization in tech and finance is a process used by businesses to securely store, transmit, and receive digital payment information. Tokenization allows customers to shop online without having to provide a credit card number or bank account details. Instead of giving out sensitive payment information, customers are issued a secure token which uniquely identifies their transaction. This token can be transmitted between two parties (a buyer and a seller) without transmitting any personal identifying information. Tokenization is becoming increasingly popular as it helps protect consumer data from theft and fraud while still providing merchants with the ability to process payments quickly and securely.

By leveraging tokenization technology businesses can reduce fraud rates significantly while still delivering an excellent customer experience by streamlining the checkout process—allowing users to make purchases quickly through either one-time payments or recurring billings without having to input their credit card details every time they shop at that particular merchant’s site.

That’s great, but what is Tokenization of assets in Web3?

First, let's look at tokenization in the context of the primary Web3 technologies enabled in TradFi:

Figure 1: TradFi is leveraging Blockchain technology, asset tokenization, and smart contracts to apply to its own use cases and financial instruments

Blockchain technology uses Distributed Ledger Technology (DLT) to significantly improve the automation, operational efficiency, of existing TradFi systems and processes. Tokenized assets (to be described below) reside on blockchain platforms and their movement and transactions are generally enacted by smart contracts, by establishing agreements in code, partially or fully automating any financial instrument or contract and enabling “trustless” agreements that minimize trust in an institution or human action for a contract to execute based on specified parameters. Read more here to better understand each of the three components and how they work together.

In this post, we will focus and deep dive on tokenization of assets. If you'd like to read more on the other foundational aspects, check out this resource for blockchain and this resource for an overview on smart contracts.

The tokenization principles described above have been applied to Web3, on blockchain technology, in order to unlock new benefits and possibilities for a broad range of assets.

Tokenization of digital assets refers to creating, issuing and managing them on a blockchain platform to increase liquidity, enhanced functionality (e.g. fractionalization), tokenization refers to a process where a digital representation of an asset is created on a blockchain, authenticating its transaction and ownership history.

The range of asset classes and potential use cases in TradFi is near limitless to include both digitized assets of existing financial instruments (e.g. stocks, bonds, carbon credits, Treasurys) as well as real-world assets (e.g. real estate, art).

You can also find a great video tutorial here of asset tokenization in the context of Web3 and blockchain.

Practical Examples of Tokenization In Web3

From a Web3 and Digital Assets perspective there is tokenization on the blockchain. There are also a great number of emerging examples of TradFi both leveraging Web3 and DeFi tech for private and custom use, as well as TradFi building on DeFi. A few examples include:

Recently, using its new tokenization platform, Goldman Sachs is trying to make blockchain based bonds happen. The bank arranged a €100 million two-year digital bond for the European Investment Bank with two other banks, all based on a private blockchain. Typically, a bond sale like this takes about five days to settle. Goldman’s settled in 60 seconds. By reducing settlement times, Goldman is lowering costs for issuers, investors and regulators. Using blockchain, TradFi can extend these benefits more broadly in fixed-income markets and across other asset classes.

DBS executed intraday repo transaction using JP Morgan’s Onyx Digital Assets network powered by blockchain. Banks use repurchase agreements (repos) for short term funding by selling securities such as U.S. Treasuries, and agreeing to repurchase them later.

JP Morgan has also leveraged Polygon, the Ethereum Layer 2 scaling technology, to trade tokenized cash deposits in a Singapore-based trial via Onyx Digital Assets, a private blockchain created by the bank.

BlackRock selected Coinbase to provide Aladdin clients access to crypto trading and custody via Coinbase Prime, creating new access points for institutional crypto adoption.

Credit Suisse, in partnership with a group of Swiss banks, tested securities tokenization on the Ethereum public blockchain and settled transactions with fiat currency. The tokenized securities were traded on BX Swiss, the FINMA-regulated Swiss securities exchange and subsidiary of Börse Stuttgart.

Additionally, the tokenization of real world tangible and intangible assets can be tokenized, including alternative assets such as real estate, commodities, funds, private equity, and debt. Read more here on the basics of real-world financial asset tokenization from Provenance. Provenance is the leading public open-source blockchain for financial services, leveraged by over 50 TradFi institutions and operating at scale today with billions of dollars of digital financial assets transacted across lending, payments and marketplaces.

The Benefits and Business Case for Tokenization

Tokenization is an important process, especially for enterprises involved in payments and money movement. It involves the conversion of sensitive data such as credit card numbers, bank account information, and other financial details into a secure digital token. This token is used to securely process transactions without exposing confidential customer information. Tokenization offers a range of benefits to businesses that make it an attractive option when it comes to protecting their customers' data.

Specific to Web3 and blockchain based environments, additional unique benefits of asset tokenization include:

Fractionalization: Tokenization allows assets to be divided into smaller units, making them more accessible to a wider range of investors. This allows for more efficient use of capital and increased liquidity.

Instantaneous Settlement: The use of blockchain technology enables the instantaneous transfer of ownership and settlement of trades, eliminating the need for intermediaries and reducing the time and costs associated with traditional settlement processes.

Increased Liquidity: Tokenization makes it possible for assets to be traded 24/7 on global markets, increasing liquidity and enabling more efficient price discovery.

Transparency and Immutability: The use of smart contracts and decentralized ledger technology ensures transparency and immutability of all transactions, providing a clear and auditable record of ownership and helping to mitigate the risk of fraud and other forms of mismanagement.

Lower Costs: Tokenization eliminates the need for intermediaries, reducing the costs associated with transactions and enabling a more efficient use of capital.

Overall, tokenization can help bring financial inclusion and democratize access to wealth by providing access to assets that were previously only available to a select few and providing a digital bridge between the traditional world and the decentralized one.

For these reasons, both generally and Web3-specific, many businesses are turning to tokenization solutions as part of their overall payment security strategy. Tokenization offers many advantages over conventional methods and provides an extra layer of protection against cyber attacks and identity theft — making it an essential tool for any business that wants its customers’ data protected from malicious actors.

Also, let's consider what TradFi industry leaders are saying about the business case and value proposition for tokenization:

Larry Fink, CEO of BlackRock (a $10 trillion asset management firm), stated "the next generation for markets, the next generation for securities, will be tokenization of securities," and will provide “instantaneous settlement” and “reduced fees” all while not disrupting BlackRock’s business model. At the same time, he mentioned that most crypto firms will not be around in the future, but that blockchain technology and associated capabilities will be very important for TradFi.

BlackRock has also partnered with Coinbase and announced a spot Bitcoin private trust, both as means to give its clients direct exposure to crypto assets which shows an embrace of DeFi as well as leveraging its underlying technology.

JP Morgan also notes in its recent whitepaper (Institutional DeFi: The Next Generation of Finance?), tokenization could potentially enable financial services to be delivered “in a more open manner.”

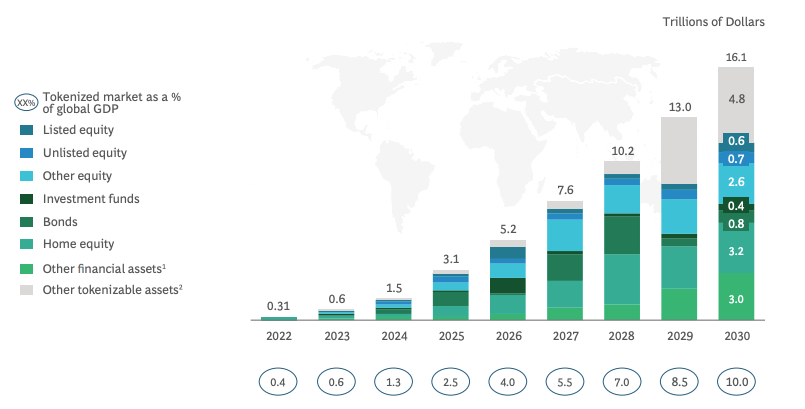

Boston Consulting Group and other industry leaders also see a very attractive value proposition for asset tokenization of real world assets that are generally highly illiquid. They estimate that by 2030, tokenization of global illiquid assets will be a $16 trillion business opportunity, and the total tokenized market to be 10% of global GDP in the same timeframe.

Figure 2: BCG estimates that by 2030, tokenization of global illiquid assets will be a $16 trillion business

The Near-Term Future of Asset Tokenization

In short, asset tokenization has the potential to revolutionize how we transact with each other by introducing unprecedented levels of security and efficiency while also providing greater access for global investors at all levels of wealth accumulation. As this technology continues to develop over the coming years, it will be interesting to see what new opportunities arise for both individuals and institutions alike due its widespread adoption around the world.

Great resources for additional reading.

Provenance: Basics of real-world financial asset tokenization

Boston Consulting Group and ADDX Collaboration: Relevance of on-chain asset tokenization in ‘crypto winter’ (additional BCG source)

NASDAQ: Tokenization: The Fabric of our Financial Future

The Defiant: Real World Assets Poised to Be DeFi Growth Engine: Coinbase

Check out the full post here at The Next Block: Software is Eating the World, and Next it Will be Tokenized.

Catch up on our most recent publications from The Next Block.

TradFi and DeFi: a hybrid hypothesis

Future of Finance - TradFi and DeFi Reference Architecture and Component Deep Dive

TradFi & DeFi deep dive 1(a): TradFi Infrastructure

TradFi & DeFi deep dive 1(b): Hybrid & Shared Infrastructure

TradFi & DeFi deep dive 1(c): DeFi Infrastructure

TradFi & DeFi deep dive 2(a): TradFi Platforms

TradFi & DeFi deep dive 2(b): Hybrid & Shared Platforms

TradFi & DeFi deep dive 2(c): DeFi Platforms

TradFi & DeFi deep dive 3(a): TradFi Applications

TradFi & DeFi deep dive 3(b): Hybrid Applications

TradFi & DeFi deep dive 3(c): DeFi Applications

Digital Assets Need Proof, Not Promises

Whether DeFi Survives or Not, Web3 Tech is Here to Stay with TradFi

DeFi has not failed, CeFi has failed… and will TradFi respond?

Decentralized Identity and the Reclamation of Your Privacy

The Next Block’s 2021 Year in Review

The Ultimate Resource for Becoming a TradFi and DeFi Expert

The Next Block's 2022 TradFi and DeFi Predictions

Must reads & weekly rollup.

Web3 (TradFi and DeFi):

(TradFi) The United States adds 223,000 jobs in December, capping a strong year for the labor market (Axios)

(TradFi) Mastercard taps Polygon for Web3 artist accelerator. Mastercard plans to leverage Polygon to help guide musical artists into the Web3 space, including with minting their own NFTs (Decrypt)

(DeFi) Robinhood shares worth nearly $500M were seized in the FTX Case. The stock was owned – via a holding company – by Sam Bankman-Fried and his FTX co-founder Gary Wang (CoinDesk)

(DeFi) DCG, a crypto conglomerate, is being investigated by DOJ, SEC. The inquiries, which appear to be in an early stage, are focused on financial transfers between DCG and its Genesis unit, according to the Bloomberg report (CoinDesk)

(DeFi) Coinbase to cut nearly 1,000 jobs. CEO Brian Armstrong said that crypto exchange Coinbase will reduce operating expenses by 25% from the previous quarter, including laying off about 950 people. At the end of September, the company had around 4,700 employees. (Wall Street Journal)

(DeFi) Binance sees $12B withdrawn in 60 days in various crypto assets since November. To Forbes, the massive outflow looks like a soft bank run. To the rest of the market, it just might be business as usual. (Cryptoslate)

(DeFi) Six crypto investors talk about DeFi and the road ahead for adoption in 2023 (TechCrunch)

Cloud:

Amazon Web Services partners with Avalanche to scale blockchain solutions for enterprises, governments. AWS will support Avalanche’s infrastructure and decentralized application (dApp) ecosystem, alongside one-click node deployments, through its marketplace (TechCrunch)

Tech:

Microsoft in talks to invest $10 bln in ChatGPT-owner OpenAI, Semafor reports (Reuters)