Decentralized Finance (DeFi): a hybrid hypothesis.

TradFi and DeFi may be more converged and symbiotic that most predict.

Today’s key story focuses on a hybrid hypothesis for TradFi and DeFi, suggesting that each are on a path of convergence as they tackle similar challenges to modernize the financial services experience, with the following hypotheses for the future:

Hypothesis #1: The future of finance is hybrid & distributed.

Hypothesis #2: The future of DeFi is multi-chain & distributed.

Hypothesis #3: The future of underlying infrastructure is multi-cloud and distributed.

Hypothesis #4: The future of finance governance is hybrid & distributed.

If you want to catch up on our reading before diving in, first check out The Next Block’s 2021 Year in Review as well as our 2022 TradFi and DeFi Predictions.

Key story: A Hybrid Hypothesis For TradFi and DeFi.

Finance technology (FinTech) has evolved significantly over the last five decades, and the latest wave of developments suggests that more change than ever before is coming for 2022 and beyond as Traditional Finance (TradFi) and Decentralized Finance (DeFi) are each on a path of convergence as they tackle similar challenges.

This leads me to believe that a very complementary, symbiotic relationship is developing and converging between traditional financial products, services and institutions with modern financial technology innovations, rather than a competitive environment where one model or set of institutions win out in the end.

Wave 1: Centralization of TradFi during the post-2008 financial crisis. A significant amount of M&A activity occurred (for example, Wells Fargo acquiring Wachovia), resulting in significant concentration of the banking sector and allowing a number of large financial services institutions to achieve incredible scale and technology spend to digitize their platforms serving a wide customer base. A great example includes JP Morgan spending $12 billion per year on technology alone.

Wave 2: Digitization of TradFi (Web2). Post-bank centralization and the financial crisis, banks started to build their own private clouds, adopt public cloud technologies, and starting the journey to go digital-native for most of their products, services, and customer experiences.

Wave 3: Decentralization and disruption (DeFi / Web3). These TradFi trends bring us to today, where completely new paradigms of Decentralized Finance (DeFi) have presented themselves, built upon a foundation of Web3 development concepts and new technologies like blockchain and cryptocurrency. However, the future may be more integrated and symbiotic than truly disruptive, which is why we maintain a hypothesis that the future of finance is hybrid, distributed, multi-chain, and distributed.

Keep reading below for deep dives on each hypothesis.

Hypothesis #1: The future of finance is hybrid & distributed. As we have learned previously that FinTech is going internet, digital and cloud-native more broadly, we hypothesize that today’s independent organizations, products, technology, and modernization paths across both TradFi & DeFi will evolve tomorrow into a future of integrated and symbiotic organizations, products, and technology roadmaps.

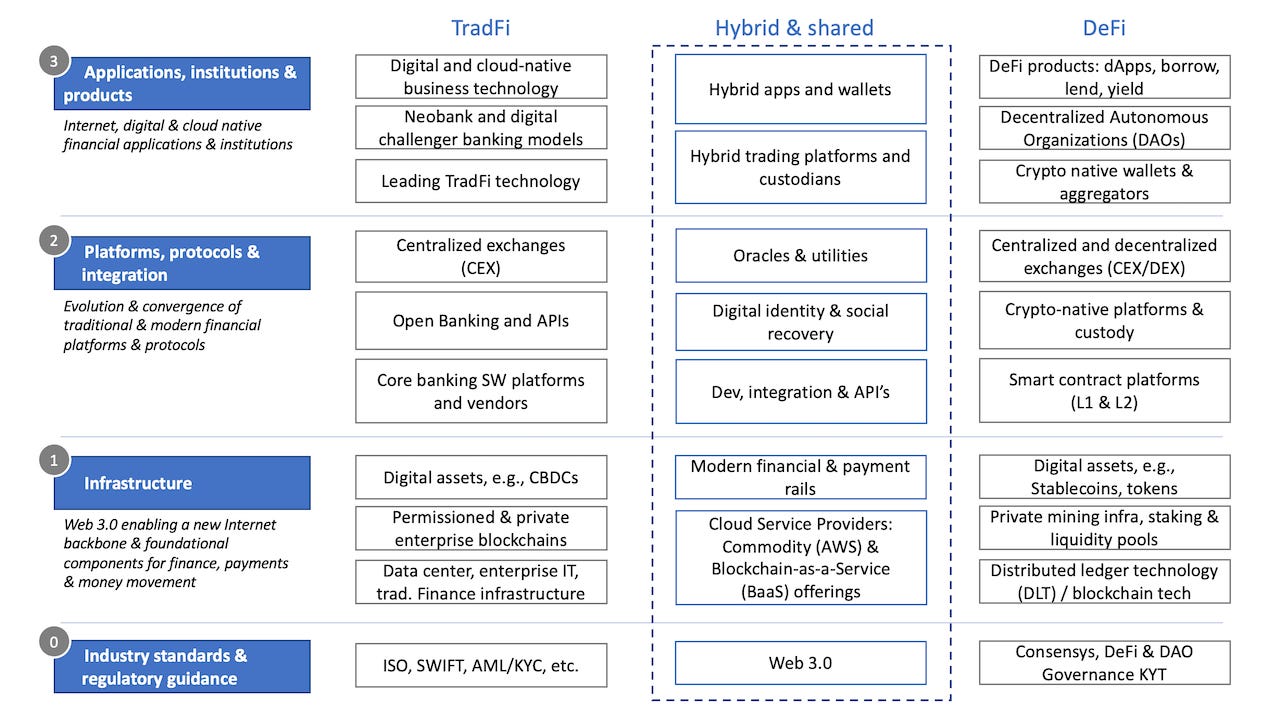

In the figure above, Traditional financial (TradFi) is described as technology components and services from incumbent banks, capital markets institutions, and cards & payments companies across applications & institutions, platforms & protocols, and IT infrastructure.

Decentralized Finance (DeFi) is described as modern financial technology components from completely new projects in the blockchain, cryptocurrency, and web3 domains across the same stack of applications & institutions, platforms & protocols, and IT infrastructure.

While most would agree with the categories above, the differentiating aspect of this continuum is the hypothesis around the hybrid and shared components that will make up the connective tissue of the hybrid financial landscape of the future, including: Interoperability & open standards; API-led connectivity & blockchain service fabric; Modern & traditional product overlap; and Financial infrastructure integration.

… let’s examine the continuum further to see what resides within each layer of the stack across TradFi and DeFi.

Traditional Finance (TradFi). TradFi starts with a bedrock of extremely mature industry standards (e.g. ISO, SWIFT messaging protocols, etc.), and regulatory guidance from various institutions (e.g. FFIEC, SEC, OCC, CFPB, FDIC, Federal Reserve) that provide guidance for all incumbents with compliance for things like Know Your Customer (KYC) and Anti-Money Laundering (AML).

For core infrastructure, traditional IT infrastructure has built the web and core financial technology as we know it today, from the establishment of the World Wide Web and networking / telecommunications protocols that are still used today, to conventional IT infrastructure like mainframe for mission critical core financial systems and physical or virtualized server technology.

TradFi typically lives in enterprise owned data centers, and more recently co-location facilities through the likes of real estate, data center and facilities providers such as Equinix, Digital Realty, NTT Data, CyrusOne, and Switch. Residing on top of traditional IT infrastructure providers we are seeing some emergence of blockchain technologies geared towards TradFi to include Hyperledger and R3, as well as digital assets largely with respect to research on CDBCs as a viable alternative to traditional money.

In the platforms domain, there are a number of centralized, traditional finance software platforms such as nCino, FIS, and Temenos that have overhauled and modernized their offerings to include digital and cloud-native platform offerings to TradFi clients, presenting a vendor based glide path to modernization so institutions don’t have to “go it alone”. Centralized exchanges (CEXs) also reside here as the backbone of capital markets via Nasdaq, NYSE, Euronext and others. More modern integration services have also made huge strides recently in enabling Open Banking and API services, to include Plaid, Stripe, Mulesoft (Salesforce) and Apigee (Google). These platforms and integrations services are forming the foundation of the modern, digital-native and interoperable financial institution for many TradFi’s.

In the software application tier, the biggest thrusts have been made with the large banks and payment providers that have established digital apps for payments and banking services, as well as challenger banking models such as Marcus for completely greenfield, integrated verticals in each TradFi’s ecosystem to deliver retail banking and investment models that rival the digital natives and FinTech challengers that have risen.

Decentralized Finance (DeFi). DeFi industry standards, governance and compliance are extremely nascent, albeit with a healthy amount of optimism by our regulators and incumbent financial leadership. As this space tries to find its footing on the technology, mainstream adoption, and how exactly to regulate the space, consortiums and other bodies like ConsenSys have taken rise to form standards, enable due diligence and auditability of blockchain-based ecosystems, and define means for governance. Decentralized Autonomous Organizations, or DAOs (treated above as institutions), also create an extremely unique and novel concept for governance of a given project or venture. If traditional and modern FinTech components and services continue to merge, with increasing adoption of crypto-native solutions, sensible regulation will be key to increase institutional, enterprise, and even consumer participation in this space.

You can find more depth here on Bankless regarding the state of crypto regulation. The World Economic Forum also recently posted a thought piece on the path forward for navigating cryptocurrency regulation.

DeFi core infrastructure is a completely new frontier that has been established in the last decade. Distributed ledger technology (DLT) forming public, permissionless blockchains was largely established and adopted with Bitcoin and Ethereum. If you are starting from square one and need to better understand blockchain and distributed ledger technology (DLT), start with the basics on Blockchain and Ethereum at Consensys.

The associated mining of cryptocurrency for Proof of Work (PoW), staking for Proof of Stake (PoS) platforms, and liquidity hubs for buying and selling of digital assets enable these blockchains to mine and transact with their native currencies and tokens. Those digital assets that are mined and used to transact on each network are manifest in stablecoins (e.g. USDC) and other token types (e.g. ERC-20 for Ethereum). Good examples of core cryptocurrency technology and mining infrastructure include Blockstream and Infura, as well as decentralized infrastructure such as Ethereum staking nodes.

Stablecoins, a type of cryptocurrency, are a new digital asset that is effectively a cryptocurrency with a value that is pegged to a stable asset as well as fully backed with reserve assets, such as the US dollar. Some of the most notable examples of these “digital dollars” include Circle’s digital dollar (USDC), the Gemini Dollar (GUSD), and DAI. Stablecoins are a great mechanism for bridging traditional and modern financial platforms and markets, and they also provide a stable and reliable base value for constructs like borrowing and lending. Today, 74% of all stablecoins are issued on the Ethereum network as ERC-20 tokens and nearly $1.6 trillion in USD in stablecoins and ETH was transacted on Ethereum in 2020, according to Consensys.

In the platforms tier, Ethereum paved the way for a number of other smart contract platforms to take rise for various use cases and technical approaches, including Solana, Cardano, Polkadot, and Avalanche. Read more here to better understand Ethereum as a platform for the future of decentralized finance by way of smart contracts and other next generation financial products and constructs. Additionally, check out some of the other up and coming platforms that are attempting to accomplish similar objectives, including Cardano, Polkadot, Solana. You can read more about these projects here as well as better understand other DeFi projects that reside in the Ethereum ecosystem.

On top of and integrated with these platforms are custodial services and centralized exchanges (CEX) and decentralized exchanges (DEX) that primarily serve the cryptocurrency markets, including Coinbase, Gemini and Uniswap. These exchanges and custodial providers often provide direct on ramps from TradFi institutions or can exchange directly with crypto-native wallets like Coinbase Wallet and Metamask. Decentralized exchanges (DEXs) have given rise lately, and are cryptocurrency exchanges that operate without a central authority, allowing users to transact peer-to-peer and maintain control of their funds. Uniswap is an excellent example of a DEX, as it provides a DeFi protocol that is used to exchange cryptocurrencies from most crypto wallets, such as Argent, Coinbase Wallet or MetaMask.

Finally, the applications and institutions in DeFi that leverage these crypto native environments, which are enabled by even more completely new concepts and approaches to financial services. There are digital and hardware wallets that allow self custody of your own digital assets, such as Ledger, Argent, and Metamask. There are DAOs that are completely governed by a decentralized community (although many are venture capital backed). And there are DeFi projects, protocols, and decentralized applications (dApps) that combine all of these concepts into extremely easy to consume services, such as Aave for non-custodial liquidity for earning interest, Maker for lending, or yearn.finance for yield farming.

Hybrid and shared components and services.

Now that we’ve explored both TradFi and DeFi, let’s discuss where they converge, and the hypotheses around what might happen in the future.

In the infrastructure space, the Cloud Service Providers serve both managed blockchain services, as well as run over half of Ethereum nodes across the top ten cloud hosting providers. The elasticity of infrastructure deployment and configuration makes for a good home to many individuals and smaller players that want to participate in the blockchain space.

The bedrock of modern infrastructure includes the big 3 Cloud Service Providers (CSPs), which host elastic, on-demand computing infrastructure for all industry workloads to include financial services. Cloud is becoming the center of gravity for the vast majority of innovation in this space, and TradFi institutions are moving to public cloud infrastructure.

In the platforms domain, a number of hybrid components have taken hold with the Consensys development suite opening up to TradFi (e.g. JPMC) as well as TradFi and FinTech incumbents expanding their aperture of services to include crypto and blockchain, such as Plaid and Stripe. A variety of both traditional FSI’s (JP Morgan, Mastercard, UBS) as well as modern blockchain institutions are involved (Protocol Labs, Maker Foundation, etc.). Consensys is one of the leading institutions that is driving the collaboration between traditional and modern institutions, and even acquired Quorom, the enterprise variant of Ethereum, from JP Morgan as part of these efforts.

Digital identity and social recovery is also a great hybrid space of convergence where Big Tech and pure play DeFi projects are trying to digitize and decentralize the concept of identity, (e.g. authorization and authentication). Read more in the hypotheses that follow to understand more about how universal, decentralized identities could replace the current patchwork, centralized mechanisms of identity tied to corporate authentication, Big Tech platform integrations and others.

Finally, the concept of oracles and utilities for methods of modern integration across TradFi and DeFi. Enablement of modern banking interoperability both with each other and with more modern tech via Open Banking and APIs is critical – e.g. Stripe, Plaid, Google Open Banking API’s. The Plaid CTO agrees with this and states that data sharing is necessary to both build a full picture, or mosaic, of the financial and customer data landscape, but also sharing and integrating this data in the right way.

Chainlink is another excellent example of blockchain integration, as it provides a reliable and tamper proof network that can retrieve data from any API, and integrate with any current or future blockchain. Chainlink is best known for “decentralized oracles”, or providing an authoritative mechanism by which other systems can look to for real world data and events, like market prices of assets. Additionally, Chainlink’s ability to securely connect smart contracts with off-chain data and services opens a number of doors for traditional and modern institutions to connect and collaborate.

Read more here on The Great Protocol Sink from Bankless to understand how protocols will establish the integration between traditional financial institutions and DeFi for a more integrated future.

In the software domain to round out the hybrid & shared components of DeFi, you have hybrid apps and wallets as well as trading and custodial services that are featuring both TradFi and DeFi assets to consumers in a single ecosystem. Great examples here include Fidelity Digital Assets, Bakkt, Square, PayPal and Robinhood.

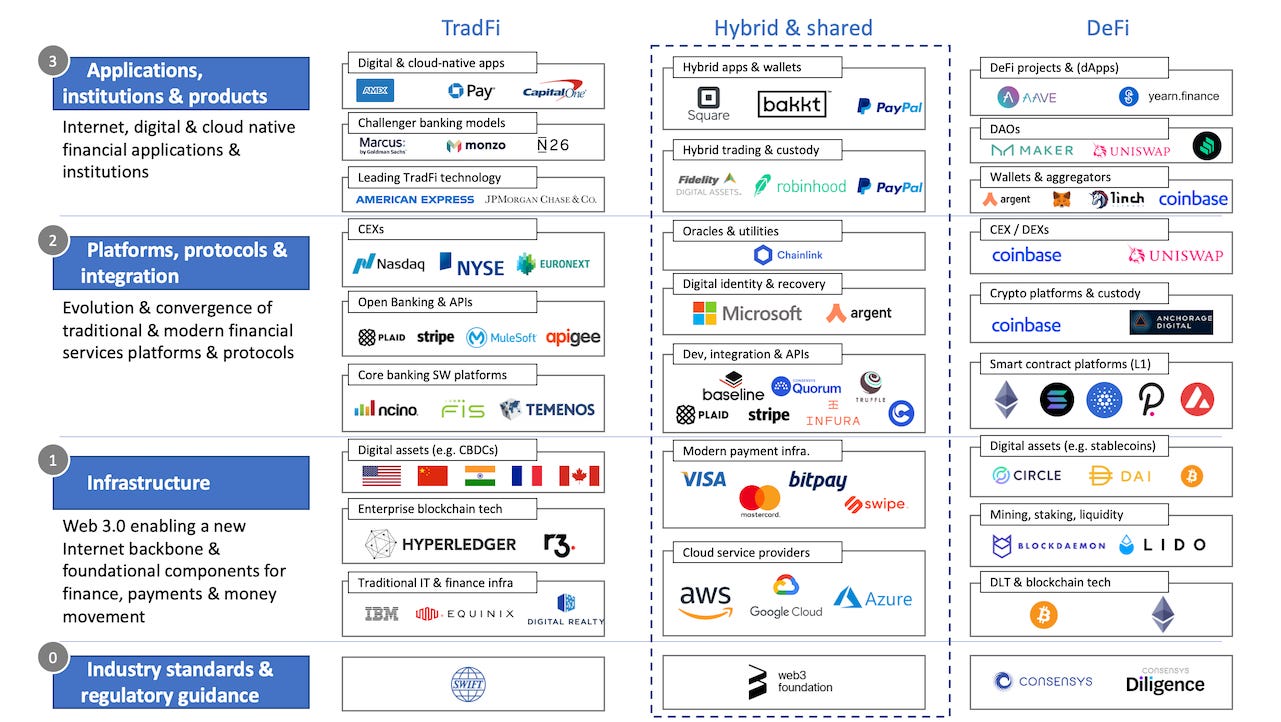

Here’s a more illustrative work of the key vendors and projects across the landscape across TradFi and DeFi:

Hypothesis #2: The future of DeFi is multi-chain & distributed. Multi-chain for Smart contracts platforms and DeFi applications looks to be the future, as a number of Layer 1 solutions have come about and seen a reasonable degree of maturity and use case development while the community continues to try and push Ethereum to its Eth2 vision. While Ethereum is furthest ahead in user community & developer interactions, platform maturity & use case adoption, other smart contracts platforms with different philosophies & design principles will continue to make smart contracts & DeFi constructs evolve & compete at light speed. Read more here for Vitalik Buterin’s views on why the future is multi-chain, but not necessarily cross-chain (original Reddit post here and Twitter post here).

Hypothesis #3: The future of underlying infrastructure is multi-cloud and distributed. If you look at the infrastructure layer across both TradFi and DeFi, the world is going toward cloud-native hosting and technology stacks regardless of organization or project. The future is hybrid and multi-cloud, with distribution of infrastructure as a demand of both TradFi institutions that want to exit owned data centers, as well as web3 and crypto projects that are distributed by design and do not have the desire or often ability to build in-house, wholly owned infrastructure.

The hyperscalers are responding to this trend as all of the “Big 3” Cloud Service Providers (CSPs) are officially strategically multi-cloud. The boundaries of these CSPs are also becoming increasingly blurry as edge and regional computing is becoming a significantly larger demand for distribution to get data and computation closer to customers and end users.

Hypothesis #4: The future of finance governance is hybrid & distributed. Your next boss might not be human. If you look at practical examples of DeFi projects using DAOs for governance like Uniswap and Compound, it provides a good indicator of what the future might look like. In the TradFi space, governance continues to be completely centralized and human oriented. However, given that TradFi is rapidly getting involved in a variety of other DeFi concepts like crypto custody, digital wallets, etc., a hypothesis that the concept of the DAO is embraced is highly reasonable, especially if a TradFi institution attempts to create a “challenger” model within the walls of its organizations in an attempt to create a greenfield, segmented crypto and web3 based business model.

This may very well leave us in an eventual hybrid state of governance, where all could be true at the same time. TradFi’s could participate in public permissionless smart contracts ecosystems like Ethereum, but also create their own governance models. DAOs could exist in pure play format but also are adopted by TradFi and centralized crypto projects. VC’s such as Andreesen Horowitz continue to back “decentralized” DeFi and Web3 projects.

… do you agree with these hypotheses, or see the future trajectory of finance technology differently?

-Must reads & weekly rollup.

Group 1: Traditional Finance (TradFi)

Visa says crypto-linked card usage tops $1 billion in first half of 2021

Fed Chair Powell: CBDC and Stablecoins Can Coexist - Blockworks

JPMorgan plots 'astonishing' $12bn tech spend to beat fintechs | Markets Insider

Group 2: Decentralized Finance (DeFi)

The Next Block’s 2022 TradFi and DeFi Predictions

The Next Block's 2021 Year in Review

Coinbase and Mastercard partner to revolutionize NFT purchase experience

Group 3: Blockchain and Cryptocurrency (Web3, Metaverse, Digital Assets, Big Tech)

Walmart is quietly preparing to enter the metaverse

Microsoft's massive metaverse move: Buying Activision for $69B

US Congressman Introduces Bill to Limit Fed's CBDC Powers - Crypto Briefing